Graziani’s theory of the monetary circuit, which combines an elegant simplicity with analytical power, has exerted a lasting influence on scholars of monetary economics. The theory provides a solid foundation on which to analyse the ongoing evolution of the financial system. In particular, it is a useful starting point for thinking about so-called ‘non-bank financial intermediation’: credit relationships which take place neither on the balance sheets of commercial banks nor through direct ownership of financial instruments such as bonds or equities.

Non-bank financial intermediation has been the subject of extensive analysis and debate across several literatures in economics, political economy, sociology of finance and more. Yet even basic questions about its nature remain unresolved. Is non-bank intermediation more like banking or more like direct market intermediation? Are the liabilities of non-bank intermediaries – repo debt and money market fund shares – monetary instruments akin to commercial bank deposits or non-monetary credit instruments?

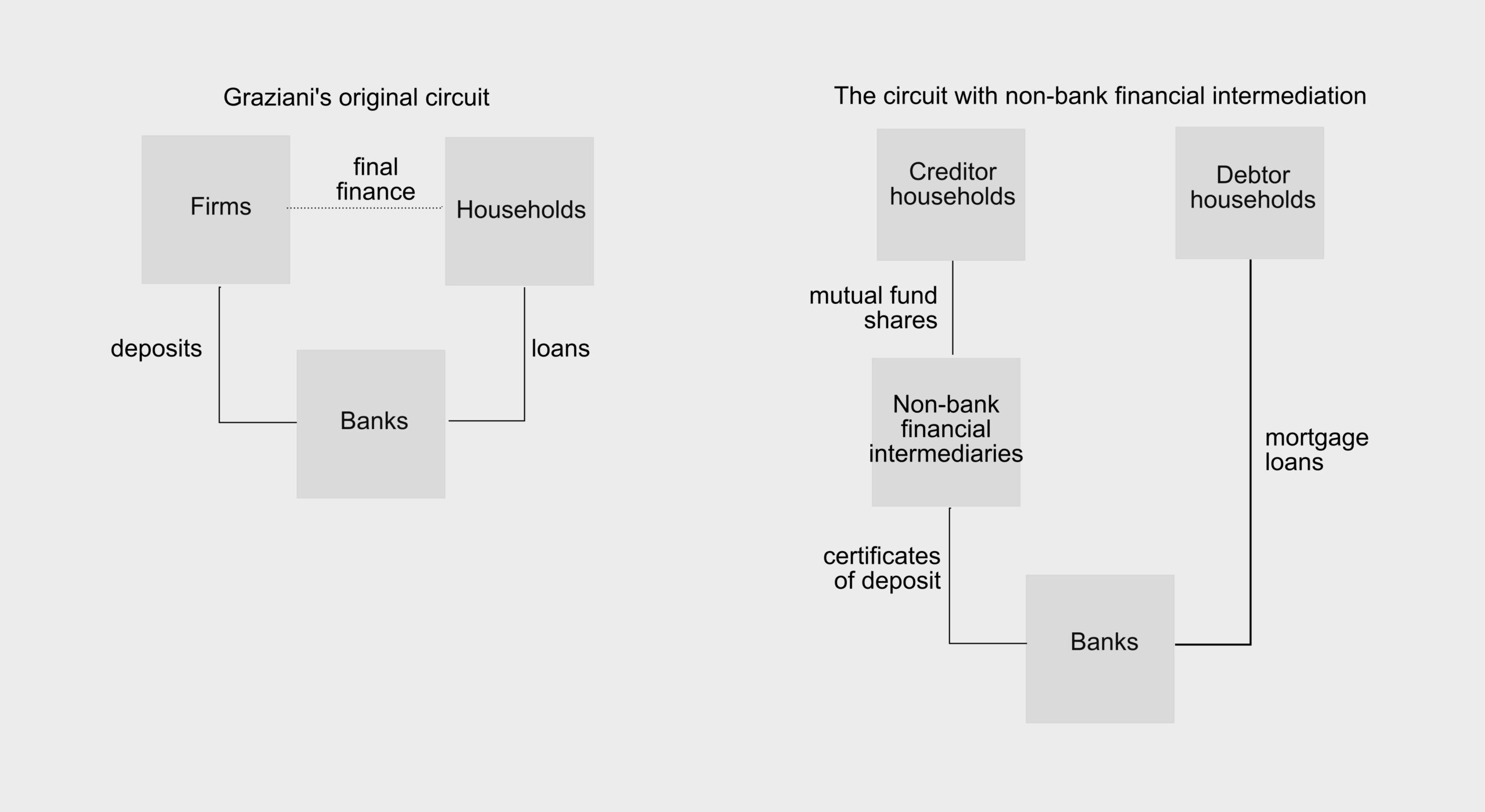

An augmented version of the theory of the monetary circuit allows us to shed light on these issues. In Graziani’s original theory, production is initiated when firms (or capitalists, in Graziani’s framing) borrow from the banking sector, which issues deposits as it makes loans. As banks lend to firms, the consolidated balance sheets of both the firms’ sector and the banks’ sector expand. Firms use newly obtained deposits to purchase inputs from other firms, and to hire labour power.

Once wages have been paid, households (or workers) hold some proportion of the total outstanding deposit balances. These deposits are matched by loans on the liability side of firms balance sheets. Households are thus effectively creditors to the firms’ sector, with the relationship intermediated via the banking sector. Yet households did not make an active decision to lend to firms: workers simply accepted payment of wages in the form of bank deposits.

Firms can subsequently reduce their debt to banks if they can persuade households to replace their bank deposits with directly issued securities. If households will buy these securities, firms are then in a position to repay bank loans, eliminating banks from the picture. Firms prefer direct financing, in Graziani’s view, because it reduces the power that banks hold over firms.

Graziani distinguishes between ‘initial finance’ and ‘final finance’: initial finance refers to the extension of credit by banks (and the concomitant creation of deposits) which opens the monetary circuit; final finance refers to the subsequent transfer of bank deposits back from households to firms which allows firms to repay bank loans and close the circuit. Graziani includes both consumption spending and the purchase of financial securities in the latter category.

How can these concepts be deployed to shed light on so-called non-bank financial intermediation? Two facts must be confronted.

First, the majority of bank credit in many rich nations is extended as mortgage debt; the means of payment is not backed by loans to firms, but by loans to households.

Second, an increasing proportion of credit relationships involve non-bank financial institutions. These institutions appear to be neither fish nor fowl: while running balance sheets on scales equivalent to large banks, they operate by issuing non-deposit liabilities and holding a range of both tradeable and non-tradeable financial assets. From the point of view of the circuit, should we consider non-bank financial intermediaries as part of the banking sector and thus initial finance, or as ‘market-based finance’ and thus final finance?

In a forthcoming paper, I argue that non-bank intermediation does not correspond neatly to either initial finance or final finance. Nonetheless, a version of the monetary circuit continues to operate. Consider the following stylised sequence of transactions.

First, a household takes out a mortgage loan. The balance sheets of both the household sector and the banking sector expand. This is initial finance, but it is not extended for the purpose of expanding production.

The household then purchases a house from another household. We now have a triangular relationship between a debtor household, a creditor household and the banking system.

The creditor household may not wish to hold bank deposits but instead may prefer some other type of relatively liquid financial asset. There are many possible reasons for this including preferences about liquidity, relative rates of return, management of default risks and so on.

If a non-bank financial intermediary offers liabilities, mutual fund shares say, the household can purchase these instruments with the result that the non-bank intermediary now has deposits on the asset side of its a balance sheet, matched by mutual fund shares on the liability side (the purist might object that these are technically equity rather than liabilities, but it makes little real difference).

Finally, the non-bank intermediary can swap its deposit balances for other bank-issued liabilities, certificates of deposit or repo loans for example. At this point, deposits are extinguished and replaced with ‘market-based’ financial intermediation. The circuit is closed. But are the relationships that remain equivalent to final finance?

The answer is no, because the bank is still the creditor of the debtor household via the mortgage loan. And the non-bank intermediary has simply inserted itself between the creditor household and the bank – it has provided a mechanism by which the bank is able to accommodate the portfolio preferences of the household.

Even in the case that more complex intermediation chains are involved – if the bank moves the loan off balance sheet through securitisation, for example – the bank will likely remain directly involved, for example through offering credit guarantees to the buyer of mortgage-backed securities.

While the monetary circuit appears to be closed, the reality is that the ‘expanded banking system’ – the commercial banks plus non-bank intermediaries – has retained its place in intermediating between credit and debtor. The triangular relationship emphasised by Graziani remains in place, although the banking system is internally disaggregated.

The expansion of non-bank balance sheets does not therefore represent the disintermediation of the big banks. Instead, as Carolyn Sissoko argues, non-bank intermediation provides a way for the big banks to expand their balance sheets beyond the limits imposed by the willingness of households to hold deposits.

The basic analytical insights of Graziani’s theory remain as relevant today as when the theory was published some twenty-five years ago. Tracing the money flows involved with non-bank financial intermediation reveals the changes that have occurred in the structure of the circuit as the institutional framework has evolved since Graziani’s original publication. What the circuit will look like in another twenty-five years is more difficult to predict.