I was not a student of Graziani’s, although I prepared my undergraduate micro and macro exams on the first version of his texts. As a young researcher I was later placed as his ‘teaching assistant’: it was an experience I still look back on with affection. We shared hundreds of exams. He always divided the written tests to be marked equally. He was friendly, ironic, often cutting in his judgements. He knew that I was a pupil of Garegnani with whom he did not have excellent relations. Nevertheless, he backed me in the selections to become associate and later full professor. When I reported this to Garegnani, he told me that the sins of the fathers should not fall on the sons. I regret not having discussed with Graziani the monetary issues that were dear to him, but which only later became one of my research topics. This subject will concern me here.

Since Marco Passarella has honoured me with a long post in which he discusses some of my remarks on Graziani’s monetary circuit theory, I will often refer to his interpretation of the theory, a reading that seems to me to be fairly shared by other ‘circuitists’. I will emphasise what unites Sraffians and circuitists, not what divides.

In Cesaratto (2017) I approached the monetary issue from the real side, namely from the theory of growth. Indeed, over the past 10 years a new Post-Keynesian theory of demand-led growth has gradually become established, one based on the concept of the supermultiplier – actually due to Hicks, and also employed by Kaldor and Gardner Ackley in his famous 1961 study on the Italian economy for Svimez. This study has similarities with the coeval study by Garegnani also for Svimez (see Cesaratto 2020).

The supermultiplier and endogenous money

The supermultiplier is a development of the Keynesian multiplier in which investment, from being an autonomous component of demand (decided ‘autonomously’ by entrepreneurs), becomes an induced component, i.e. driven by expectations about aggregate demand. Let me say that this is the best investment theory available in economic analysis (it is usually known as the ‘accelerator’ theory). In the model, aggregate demand – and thus expectations about its development – is driven by the autonomous components of demand. These are defined as those expenditures that do not depend on an already earned income and do not generate productive capacity (i.e. they do not include investment which is demand-induced). One can already glimpse here a role for monetary analysis along lines that evoke Graziani’s seminal accent on banks’ endogenous money creation to explain the sources of financing of the autonomous components. The analysis of the supermultiplier was ‘rediscovered’ almost simultaneously by Heinrich Bortis (University of Fribourg, Switzerland) and, with greater impact, by Franklin Serrano (UFRJ, Brazil) who dubbed it ‘Sraffian’ because it assumed an exogenous income distribution. (Incidentally, in the Cambridge model by Kaldor, J. Robinson and Pasinetti the distribution is instead endogenous, depending on the capitalists’ choices about the desired growth rate; Sraffa looked at it with much scepticism because it deprived class conflict of any role in the determination of distribution). I should say that when I met Franklin Serrano in Cambridge in 1990 and he told me about the supermultiplier, he preached to the converted. But where had I heard about it before? Probably read in Ackley’s macroeconomics textbook (in the second edition, I think, which is sometimes considered less beautiful than the first), but I assure you that I went to the library to inspect the various editions of Graziani’s macro textbook, including the one I studied, which was the earliest, somewhat more ‘orthodox’ version. I remember that the income-expenditure circuit as explained there remained very much in my mind. What a pity, however, that in the later editions of the micro or macro manuals the advances in monetary theory Graziani himself contributed to did not, it seems to me, find space. (Bellofiore tells me this is not so, but I tested hundreds of students over those texts and I would have been the first to learn about it. But maybe I was then unable to pick subtle messages up).

I remember also that when I was assisting Graziani, I was aware that he was interested in money, and I raised the question which troubled me to him several times: if savings do not finance investments, what does? The answer I gave myself was that it could only be the banks who create purchasing power from nowhere, but how was unknown to me. I realise now, however, that this was not the way Graziani approached the problem: mine was money and demand, his was money and production. I understood this difference better later, when I came back on these issues from the supermultiplier perspective, where the question emerges on the demand side as one of who finances investment and autonomous demand (Cesaratto 2017).¹

Let me add that the concept of autonomous demand has ancient and noble progenitors, notably Rosa Luxemburg and Michal Kalecki’s ‘external markets’: what else are these if not autonomous demand coming from outside the income-expenditure circuit? (Cesaratto 2015). It seems to me that Bellofiore and Passarella (2009) show similar sensitivity here, pointing to a connection between endogenous money and autonomous expenditure that has been given, in my view, new life in the analysis of the supermultiplier. In Kalecki the role of banks in financing investment spending and initiating the circuit is also well explained. Of course, I fully agree with Passarella (2024) that whatever relevance one wishes to attribute to the demand side, it should not be confused with a supposed ‘consumer sovereignty’.

How do capitalists decide?

In Graziani’s view, which Passarella echoes, the role of banks is fundamentally about financing production decisions ‘autonomously’ made by firms (or by capitalist entrepreneurs). Marco accuses me of reading ‘conspiracy’ into such autonomous corporate power. I admit my fault. The point is that I believe that the analysis of firms’ production decisions cannot be separated from the analysis of expected demand and its real determinants (e.g. fiscal, monetary and foreign exchange rate policies). Faced with the idea that companies ‘unilaterally’ decide something, my memory goes to Marx’s famous passage in ‘18 Brumaio’ whereby ‘[Women and men] make their own history, but they do not make it as they please; they do not make it under self-selected circumstances, but under circumstances existing already, given and transmitted from the past’. ² In short, there is a danger of slipping from the sovereignty of consumers to the sovereignty of corporations (backed by banks), which is certainly there, but still within a complex of social, political and economic relations. Also, it is not very clear whether this corporate autonomy is manifested in the autonomy of the individual entrepreneur-capitalist or with reference to the capitalist class. Kalecki is very clear on this: entrepreneurs decide many things as a class around a table (or in exclusive clubs), but not investments and certainly not the level and composition of production, let alone income distribution), capitalists being in competition with each other. ³ Of course privileged access to bank credit is a class element, Passarella is right to point this out, as is the influence of business on economic policy decisions and, at the bottom of it all, the ownership of the means of production.

It is by influencing the autonomous expenditure financed by endogenous money generation that, Kalecki suggests, capitalists influence the level and realisation of potential surplus, i.e. profits. [iv] The influence goes through channels that are much more complex than a planned decision on the composition of production: it mainly takes place by affecting the economic policy decisions that ultimately impact upon autonomous spending. It also occurs, of course, through their privileged access to bank financing of luxury autonomous consumption. Through their influence on autonomous expenditure, either directly or, more importantly, through economic policy, capitalists also influence the employment rate, the relative bargaining power of social classes, and the level of real wage. The supermultiplier seems a very appropriate ‘core’ to this complex analysis of the intricate and often hidden influence of capitalists on accumulation and distribution.

To summarize, it seems to me that Passarella captures a Marxian element in the ‘logical scheme’ of the monetary circuit, namely the fact that at the top of everything is the power of capitalists. However true this fact may be, it is a power that manifest itself in more complex forms of ‘autonomous decisions about the level and composition of production’. Instead, control over the level and composition of production is exercised particularly through the control that capitalists exert in various forms over economic policy and thus over the development of the level and composition of aggregate demand and the levels of employment of labour (for a full discussion see Summa, Serrano and Freitas 2024, section 5).

Sraffa and Kalecki: Level and Wage of Profit.

This line of reasoning also gives me the opportunity to clarify that Kalecki’s idea that by directing the level and composition of aggregate demand and production entrepreneurs influence the distribution of income does not contradict Sraffa’s conflictual theory of distribution which assumes a given level of production.5 Suppose we start from a situation where production capacity is normally utilised and therefore, given the wage rate, the profit rate is also at its normal level. If the capitalists decide to consume more using bank financing (or to lobby the government to spend more on, say, armaments), other things being equal, production will increase and the degree of utilisation of productive capacity will rise above the normal level, and so will the current rate of profit at the given wage rate. The amount of profits will also increase. If the increase in demand is persistent, investments made to restore a normal degree of utilisation will subsequently bring the degree of utilisation and the rate of profit back to the normal level. Thus, the conditioning exerted by capitalists via autonomous demand on distribution concerns, to a first approximation, the absolute amount of profits and wages, given their relative proportions (the distributional shares) and the normal wage and profit rates. 6

However, changes in the employment rate of the labour force, especially if permanent, may later lead to a change in the real wage and thus in the normal profit rate. The change in normal distribution will in turn have an effect on the ‘supermultiplier’, influencing the marginal propensity to consume, and thus on the level of income generated by the given autonomous expenditure, and finally on the absolute amount of profit and wages.

Monetary circuit and supermultiplier

If there is a disagreement with Graziani – who was deemed by his followers to be sufficiently deferenntial, which reassures me – I have also tried, at a later stage, to identify not only points of convergence, but to integrate the money-production nexus dear to the professor, and the money-demand nexus proper to the Luxemburg-Kalecki tradition to which the Sraffian supermultiplier refers (Cesaratto 2017).

In the demand-led monetary circuit suggested by the supermultiplier, endogenous money does in fact appear in a first approximation as the financing of autonomous expenditure, namely of autonomous consumption, of public spending, of exports. Although induced by the historically prevailing trend in aggregate demand, investment is also financed by endogenous money creation. That autonomous consumption is financed by credit creation is quite obvious, particularly if one thinks of mortgages for the purchase of new homes, which are mistakenly placed by statisticians among investments (in lieu of among consumption financed by consumer credit). More complex are the cases of financing public expenditure and exports.

From the Keynesian point of view taxes and savings are the result of public spending and not vice versa (‘the state spends first’), but how does the state finance itself (especially since primary financing from the central bank is generally prohibited)? Along the lines indicated by Randall Wray and Marc Lavoie, I have suggested that it is again the banks that create money for the state (banks that are, in fact, the primary dealers in well-organised auctions of government bonds), with subsequent intervention by the central bank to fill any shortage of bank reserves (Cesaratto 2016). 7 Endogenous money creation may also be needed in export financing. It can take the form of ‘vendor finance’, through the ex-nihilo generation of loans by banks in the exporting country in favour of buyers in the importing country, or simply through bank credit in the importing country aimed at financing the purchase of consumer or production goods from abroad (Dalziel and Harcourt 1997, Cesaratto and Di Bucchianico 2020). We can usefully refer here to the Keynes-Graziani notions of initial (financing) and final (funding) finance, whereby initial expenditure determines via income multiplier additional saving, with the process coming to a halt precisely when the deposit initially created ex nihilo by the bank consists of savings, i.e. final finance (funding). 8 To avoid misunderstandings about endogenous money, the answer to the question: ‘do banks lend out pre-existing savings?’ is no. But to the question: ‘against the stock of loans there is a stock of savings’ the answer is yes (Cesaratto and Pariboni 2022).

This scheme whereby endogenous money creation finances autonomous expenditure, and secondarily also investment, implies, however, that production is decided on the basis of orders in which the price of the good is advanced by the buyer so that the enterprise can use the advanced revenue to start production without having to resort in turn to bank credit. However, this is not always the case. Only in some cases does production take place based on orders, namely for capital goods and otherwise complex goods. By contrast, when we go to the supermarket, or to the hairdresser, we are not preceded by an order. And even where there is an order, the monetary advance paid by the ordering side is usually only partial. Here, then, the role of production financing emerges strongly: whether production decisions are made based on orders with no full advance payments, or on the basis of expectations (in the most frequent cases where there is no order), companies will resort to bank credit to finance (partially or fully) the start of production.

It surprises me how little research has been done into where the banking system intervenes in practice: in the financing of orders or production, or in what combination. This affects the distribution of risks of bank credit between the producer and the buyer, itself the result of the relative power of the parties involved in the transaction.

Let us therefore assume, à la Graziani, that bank financing concerns production decisions made based on orders with no advances, or based on expectations of forthcoming demand. (Of course, expectations do not hang on themselves but on the historically contingent trend of aggregate demand as suggested by the supermultiplier). More than Graziani, however, I have followed here Paul Davidson (1986) – another economist certainly not sympathetic to Garegnani!

Demand financing or production financing?

Davidson assumes that an investor places an order for a piece of production equipment instructing an investment fund9 to raise adequate finance with which to pay for it once the asset has been delivered (thus assuming zero down payment). 10 The manufacturer of the equipment will turn to his bank to obtain adequate financing for the production let us assume for a value equal to that of the investment (this is initial finance). This expenditure will generate an income multiplicative process by generating savings equal (by definition) to the value of the investment. These savings are precisely those that the fund collects and hands over to the investor (this is final finance or funding). The investor pays the order, so that the producing enterprise can in turn repay the initial credit. In this way, the money initially created is destroyed.

It seems to me that in this way I have tried to usefully link the insights from Keynesian theory (that of the General Theory) with Prof. Graziani’s emphasis on the financing of production. I have deliberately eschewed some specific problems here, in particular that of profits in the circuit, but this is not the place to discuss them. 11

Passarella (2024) is very keen to emphasise the ‘class’ aspect of the financing of production, i.e. the power of capitalists to purchase the labour-force. There is no doubt that I have mainly emphasised the macroeconomic aspect of this facet, leaving the class aspect in the background. Access to bank credit and the consequent power to rent labour-force is certainly an aspect of capitalist class relations that should rightly be kept in mind.

On a more analytical level, Passarella sounds instead wrong when he argues that autonomous consumer financing does not constitute initial financing. This is not the place to present another Davidsonesque example, but the sequence of events would not be dissimilar to the one above.12

Notably, Barba and Pivetti (2009) have also identified a class element in consumer credit, in what Bellofiore called – before the great financial crisis – the model of the traumatised worker (after the years of Thatcherism and Reaganomics) and the indebted consumer (see e.g. Bellofiore 2012): the class element lies in capitalism’s need to sustain aggregate demand, which is negatively affected by an increasingly unfavourable distribution of income to workers, through the financing of their autonomous consumption. Of course, this is a subjugation of workers to the financial system that is ancillary to their subordination as manifested in the relations of production, since it is of course true that in itself ‘consumer credit does not incorporate any necessary class relation’, as Passarella points out. It is, however, an element of capitalism that falls fully within the vision dear to Rosa Luxemburg of the need for ‘external markets’ (autonomous consumption is an external market on a par with the market of peripheral countries or military spending). I would finally like to return to the fact that, following Kalecki’s lesson, through the control of aggregate demand and employment levels by means of monetary and fiscal policy, capitalists exercise a non-secondary control over labour power and distribution.

* Presentation for the conference “L’insegnamento di Augusto Graziani, tra teoria e politica economica. A dieci anni dalla scomparsa”, Università del Sannio, Benevento, 9 e 10 maggio 2023. I thank Riccardo Bellofiore for valuable comments and Giancarlo Bergamini for improving the exposition.

** Sergio Cesaratto is full professor of European Monetary Policy, International Economics, and Growth & Development at the University of Siena. He is author of Heterodox Challenges in Economics – Theoretical Issues and the Crisis of the Eurozone, Springer Nature Switzerland, 2020.

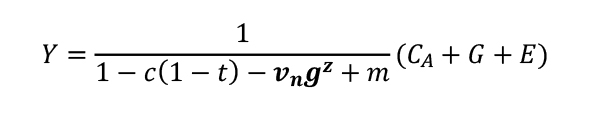

1 In supermultiplier analysis, the level and growth of income is governed by the autonomous components of aggregate demand that do not create productive capacity, typically autonomous consumption (CA) government spending (G) and exports (E). Investment is induced by the growth rate of aggregate demand according to the traditional investment accelerator theory. A standard formulation of this model is in the following equation, which is an easily understandable development of the classical Keynesian multiplier with government in an open economy where the terms have the standard meaning,

and investment is explained by an equation of the type I = vngz evoking the accelerator theory which is embodied in the denominator of the supermultiplier.

2 https://www.marxists.org/archive/marx/works/1852/18th-brumaire/ch01.htm.

3 “[C]apitalists do many things as a class but they certainly do not invest as a class” (Kalecki 1971, p. 152).

4 In another celebrated passage Kalecki argues that: “Now, it is clear that capitalists may decide to consume or to invest more in a given period than in the preceding one, but they cannot decide to earn more. It is, therefore, their investment and consumption decisions which determine profits, and not vice versa.” (Kalecki 1971), pp. 78–79.

5 As well-known, in the classical approach to income distribution the level and composition of social output are taken as given along with the technical conditions of production and one distributive variable (the wage rate or the profit rate). The given social output is the one corresponding to a normal degree of utilisation of existing capacity. On the notion of normal degree of capacity utilization see Trezzini and Pignalosa (2024).

6 It seems to me that a similar interpretation is put forward by Hein (2023, p. 36) who, following Kalecki, takes the normal rate of profits as determined by the monopoly degree: “Profits are thus determined by capitalists’ autonomous consumption, by their investment in capital stock and by the propensity to consume or the propensity to save out of profits (…). … we [thus] arrive at a first Kaleckian multiplier, which contains the sum of profits realised by the firms as a multiple of their autonomous consumption and investment expenditures. Since income distribution and hence the share of profits in national income are mainly determined by the mark-up in firms’ price setting, the change in profits takes place through a change of aggregate production, thus the degree of utilisation of the capital stock, and in national income”.

7 The purchase of government bonds by banks implies in fact the transfer of reserves from their accounts with the central bank to the treasury account of the government. The central bank may have to intervene to fill any shortage of reserves in bank accounts. Ultimately, it would be the central bank that bought the government bonds. See Cesaratto (2016) and Cesaratto and Di Bucchianico (2020).

8 The mystery of how this happens lies in the Keynesian multiplication process. A deposit initially created to finance an autonomous expenditure changes hands continuously as the income multiplier unfolds. At each step, however, a part of it is set aside as savings. At the end of the process, the initial deposit will consist entirely of savings (Dalziel 1996).

9 An investment fund raises funds by issuing bonds and lends them out over the long term. Unlike a bank, it is merely an intermediary of funds. The investment fund may of course be a section of a bank that deals in long-term financing.

10 We might well assume that the buyer is instead asked to make a down payment loaned by a bank, the only one that can create purchasing power, which subsequently issues bonds to replace short-term financing with long-term financing. This would obviously reduce the producer’s need to for initial finance. The story we tell would substantially remain the same.

11 Interesting points emerged in this regard at the conference. I am referring in particular to the speech by Prof. Giorgio Gattei in which the realisation of the profits was linked, it seemed to me, to autonomous expenditure – thus to Luxemburg-Kalecki’s external markets.

12 We can think of a ‘financial company specialising in credit for workers and pensioners, like the advertiser of ‘rata bassotta’ on the metro in Rome (‘cane bassoto’ in Italian is dachshund dog). Suppose a family intends to finance a wedding dinner and resorts to “rata bassotta”. Assuming that the restaurant does not ask for advances, it will finance the expenses for the lunch by resorting to bank credit (initial finance), which it will repay as soon as the bill is settled. The expenditure generates income and savings. The financial company collects these savings by issuing bonds, disbursing the proceeds to the family (final finance or funding), which thus settles the bill. The household is, of course, left with a longer-term debt. Many variations are possible.

References

Barba, A. and Pivetti, M. (2009)

- Rising household debt: Its causes and macroeconomic implications a long-period analysis, Cambridge Journal of Economics, 33(1), 113–137.

Bellofiore, R. (2012)

- La crisi globale, l’Europa, l’euro, la Sinistra, Asterios, Trieste.

Bellofiore, R. and M. Passarella (2009)

- ‘Finance and the realization problem in Rosa Luxemburg: a “Circuitist” reappraisal,’ in J.F. Ponsot and S. Rossi (eds), The Political Economy of Monetary Circuits, London: Palgrave Macmillan, pp. 98–115.

Cesaratto, S. (2015)

- Neo-Kaleckian and Sraffian Controversies on the Theory of Accumulation, in Review of Political Economy, Vol. 27, No. 2.

Cesaratto, S. (2016)

- The State Spends First: Logic, Facts, Fictions, Open Questions, Journal of Post Keynesian Economics, 2016, 39 (1), 44-71.

Cesaratto, S. (2017)

- Initial and final finance in the monetary circuit and the theory of Effective Demand, Metroeconomica, Volume 68, Issue 2, 228–258.

Cesaratto, S. (2020)

- Garegnani, Ackley and the years of high theory at Svimez, capitolo 8 di Hassan Bougrine and Louis-Philippe Rochon (eds.), Economic Growth and Macroeconomic Stabilization Policies in Post-Keynesian Economics, Edward Elgar Publishing (tribute to Marc Lavoie and Mario Seccareccia).

Cesaratto, S., and Di Bucchianico, S. (2020)

- Endogenous money and the theory of long period effective demand. Bulletin of Political Economy, 14(1).

Cesaratto, S., and R. Pariboni (2022)

- The relation between Keynesian monetary theory and Sraffian economics: a critical exploration Review of Keynesian Economics, vol. 10 (3) (Autumn).

Dalziel P. C. (1996)

- The Relevance of the Keynesian Multiplier Process After Sixty Years, History of Economics Review, 25 (1), 221-231.

Dalziel P.C., Harcourt G.C. 1997

- A Note on “Mr Meade’s Relation” and international capital movements, Cambridge Journal of Economics, 21 (5), 621–31.

Davidson P. 1986

- Finance, funding, saving, and investment, Journal of Post Keynesian Economics, 9 (1), 101-110.

Hein, E. (2023)

- Macroeconomics after Kalecki and Keynes: Post-Keynesian Foundations, Cheltenham: Edward Elgar.

Kalecki, M. (1971)

- Selected Essays on the Dynamics of the Capitalist Economy 1933-1970, Cambridge: Cambridge University Press.

Marx K. (1852)

- The Eighteenth Brumaire of Louis Bonaparte, reprinted by Progress Publishers, Moscow (1937). Online at https://www.marxists.org/archive/marx/works/1852/18th-brumaire/index.htm (number pages not available) (accesso 8 giugno 2023). Trad. it. www.marxists.org/italiano/marx-engels/1852/brumaio/cap1.htm%20

Passarella Veronese, M. (2022)

- Sequenza e classi: una risposta ai critici della teoria del circuito monetario, https://augustograziani.com/it/2022/09/18/sequenza-e-classi-una-risposta-ai-critici-della-teoria-del-circuito-monetario/

Summa, R., Serrano, F., e Freitas, F. (2024)

- The SraffianSupermultiplier and the Exogenous Growth Debate, IE-UFRJ Discussion Paper 006 | 2024, forthcoming inHandbook of Alternative Theories of Economic Growth, Second Edition, edited by Mark Setterfield

Trezzini, A., and Pignalosa, D. (2024)

- Determining the Normal Degree of Capacity Utilisation: Insights from the History of Economic Thought. Review of Political Economy, 1–26.