There have been critics of Neoclassical economics virtually since its inception in the 1870s: the very word was coined by Veblen as a term of ridicule rather than of praise (Pratten 2023, p. 63). But despite this, Neoclassical interpretations of economic concepts still permeate the minds of its critics. As Samuelson once said:

“I don’t care who writes a nation’s laws—or crafts its advanced treaties—if I can write its economic textbooks.’ The first lick is the privileged one, impinging on the beginner’s tabula rasa at its most impressionable state” (Samuelson 1990, p. ix).

This applies to critics of Neoclassical economics as much as it does to true believers. Despite rebelling against the Neoclassical orthodoxy, they often fall into using its ideas or methods, since, as Keynes said:

The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.(Keynes 1936, Preface, 13 December 1935).

Therefore, the great advances in heterodox economics have come from critics who have found a way to frame an economic concept that is not beholden to the engravings made on their impressionable young minds by their Neoclassical instructors. I will forever be grateful to Augusto Graziani for his pivotal reframing of what exchange is in a capitalist economy.

Graziani’s Revolutionary Contribution

According to Neoclassical theory, exchange is an act involving two agents and two commodities, and the key to exchange is working out an exchange ratio between the two commodities which will satisfy both parties. This is fundamentally a process of barter, and it leads inexorably to an equilibrium view of capitalism.

Graziani’s revolutionary insight—in the scientific sense (Kuhn 1970)—in his pivotal paper “The Theory of the Monetary Circuit” (Graziani 1989) was that transactions in a monetary economy involve one commodity, and are three-sided, involving a buyer, a seller, and a bank:

In order for money to exist, three basic conditions must be met:

a) money has to be a token currency (otherwise it would give rise to barter and not to monetary exchanges);

b) money has to be accepted as a means of final settlement of the transaction (otherwise it would be credit and not money);

c) money must not grant privileges of seignorage to any agent making a payment.The only way to satisfy those three conditions is to have payments made by means of promises of a third agent, the typical third agent being nowadays a bank. When an agent makes a payment by means of a cheque, he satisfies his partner by the promise of the bank to pay the amount due. Once the payment is made, no debt and credit relationships are left between the two agents. But one of them is now a creditor of the bank, while the second is a debtor of the same bank. (Graziani 1989, p. 3. Emphasis in original).

That insight—derived by working from first principles about what distinguishes a monetary economy from a barter economy—solved in an instant a dilemma I had felt ever since Hyman Minsky had alerted me to the pivotal importance of private debt in a capitalist economy:

Stable growth is inconsistent with the manner in which investment is determined in an economy in which debt-financed ownership of capital assets exists… the fundamental instability of a capitalist economy is upward. The tendency to transform doing well into a speculative investment boom is the basic instability in a capitalist economy. (Minsky 1977; 1982, p. 67).

I had developed a mathematical model of Minsky’s Financial Instability Hypothesis in which the dynamics of private debt could lead to a debt-deflation (Keen 1995), but though debt was pivotal to my model, money played no explicit role. I knew from Basil Moore that bank debt created money (Moore 1979), but how to tie debt and money together eluded me until I read Graziani.

After reading Graziani, I knew that I had to explicitly include banks in macroeconomic modelling; that transactions should be modelled as flowing through the deposit accounts of banks; and that banks influenced the levels and rates of change of those deposit accounts through the act of lending. Graziani’s revolutionary insight led ultimately to the creation of Minsky (https://sourceforge.net/projects/minsky/), the Open-Source system dynamics program named in honour of Hyman Minsky, which explicitly models the monetary system using interlocking double-entry bookkeeping tables named after yet another great Post-Keynesian economist, Wynne Godley.

Graziani’s shortcomings

Though I regard “The Theory of the Monetary Circuit” as one of the pivotal influences on the development of my own approach to economics, Graziani was not immune to the difficulty Keynes described. There were many other aspects of his work that I rejected, precisely because they were not revolutionary, but still based on bad Neoclassical habits (please forgive the oxymoron). The most striking to me, on my first reading of Graziani, was this discussion of worker behaviour:

An assumption is therefore required for the existence of a money stock, namely that wage-earners spend their money incomes gradually over time. This may well seem an assumption of irrational behaviour, if no uncertainty is present. It is however a necessary assumption, if we do not want the velocity of circulation to become infinite and money to disappear altogether from the system. (Graziani 1989, p. 6).

It is not at all irrational to assume that workers “spend their money incomes gradually over time”. Workers—and all other agents in an economy—do spend “their money incomes gradually over time”, because we exist in time, and not in the bizarre Neoclassical space called “General Equilibrium”. What is irrational is the elimination, by Neoclassicals, of serious consideration of change through time via concepts like “General Equilibrium”, and the “the long run”. In the long run, we are still in the short run. All flows, at the macroeconomic level, occur gradually over time.

Graziani attempted to handle time via the construct of period analysis, which led to his concepts of “initial finance” and “final finance”—marking the beginning and ending of the “period” respectively. But periods are almost as artificial as equilibrium itself, and they lead to the dilemma pointed out by Fontana, that all the interesting things—changes in expectations, investment, etc.—happen between periods, rather than during them.

A single period is the minimum effective unit of economic time for the analysis of agents involved in the economic process. The length of this period is such that changes in expectations never occur within it but rather at the junctions of one single period to the next… Once a single-period framework is adopted, the choice is made: little change will occur within it. Expectations can be disappointed, but their effects are not allowed to alter the current course of events. Any shift in the expectational functions of agents has to wait for the next period. (Fontana 2004, pp. 378-379).

In reality, macroeconomic time is not segmented into periods, but is continuous, and change occurs continuously, not in stop-start staccato between periods. Though individual actions are discrete, the macroeconomic sum of many asynchronous discrete microeconomic behaviours becomes a continuous flow of macroeconomic expenditures (Andresen 1998). Though there are initial conditions—reflecting the state of the economy at a specific point in time—there is neither initial finance nor final finance, but continuous finance. Keynes, and not Graziani, was correct here:

Credit, in the sense of ‘finance,’ looks after a flow of investment. It is a revolving fund which can be used over and over again. It does not absorb or exhaust any resources. The same ‘finance’ can tackle one investment after another. (Keynes 1937a, p. 247).

This reality is easily handled by the mathematician’s tool of differential equations, on which Minsky is based.

Modelling Graziani

Once the Neoclassical remnants are removed from Graziani’s ideas, his revolutionary insights remain. Banks are an essential part of capitalism, all transactions are monetary—and therefore “three-sided, involving a buyer, a seller, and a bank”—and the expansion and contraction of economic activity is driven largely by the expansion and contraction of credit.

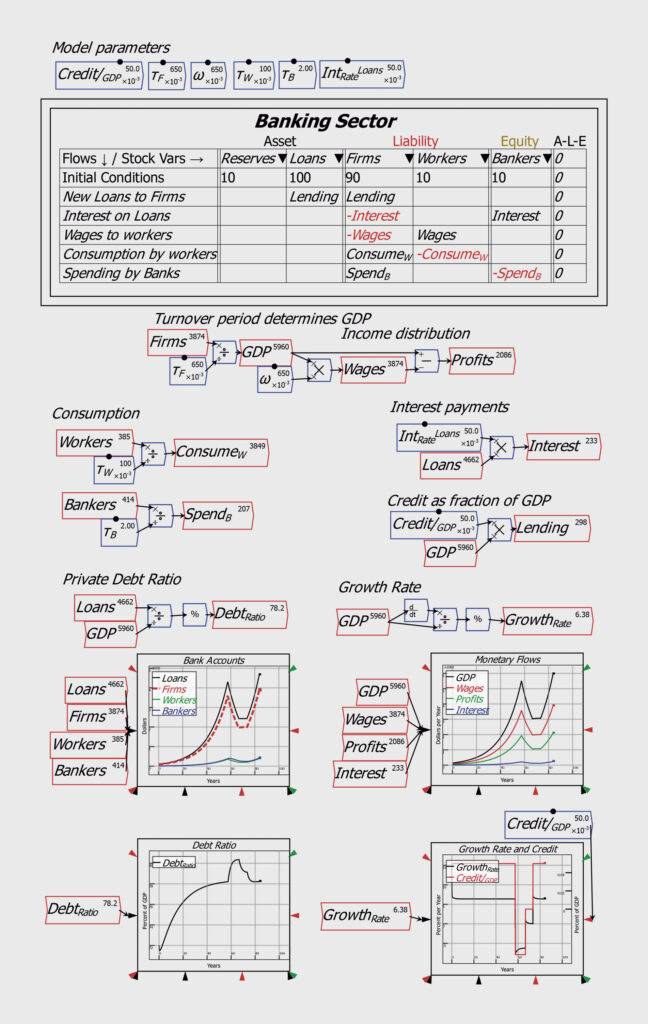

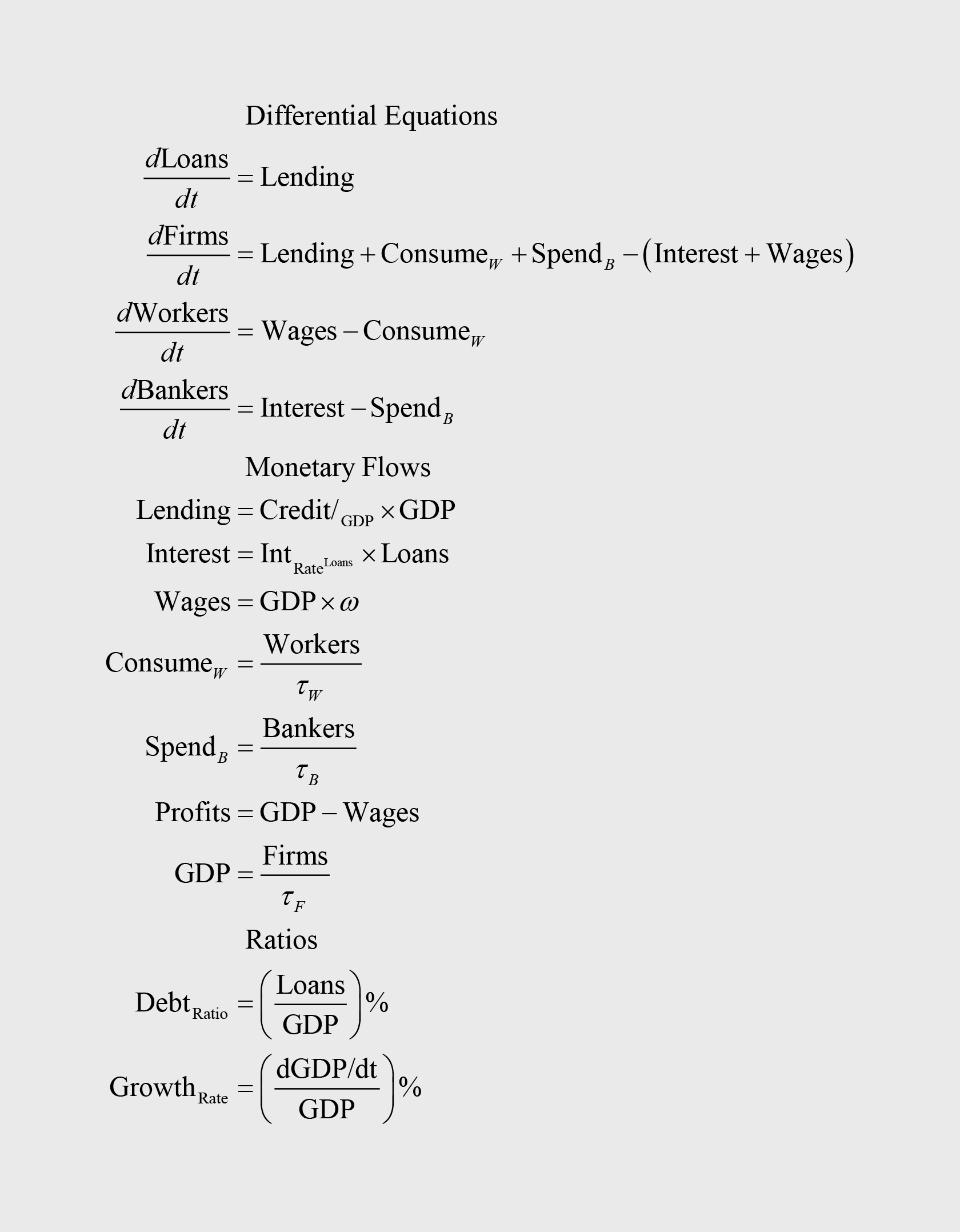

Figure 1 shows an extremely simple model of the monetary circuit in Minsky, and the dilemmas that Graziani hypothesized—such as “If on the other hand, wage-earners decide to keep part of their savings in the form of liquid balances (that is, banking deposits), firms will get back from the market less money than they have initially injected in it” (Graziani 1989, p. 5)—disappear, precisely because they were based on inappropriate Neoclassical concepts of equilibrium.

Far more sophisticated models than this can be constructed, including ones with the physical system of production, from which phenomena can arise that disturb the monetary system—and vice versa. But such models would not have been possible—the invention of Minsky would not have been possible—without Graziani’s profound insight into the triangular nature of economic exchanges.

Figure 1: A simple model of the monetary circuit in Minsky

Meeting Graziani, physically and intellectually

I met Graziani on two occasions. The first was at the 1996 Monnaie et Production conference in Paris, at which, as Mario Seccareccia outlines on this blog, there were acrimonious exchanges between Vicki Chick and Augusto. The second was in Bergamo in 1998, at the conference commemorating Hyman Minsky which led to the book series The economic legacy of Hyman Minsky, edited by Riccardo Bellofiore and Piero Ferri (Bellofiore and Ferri 2001; Keen 2001).

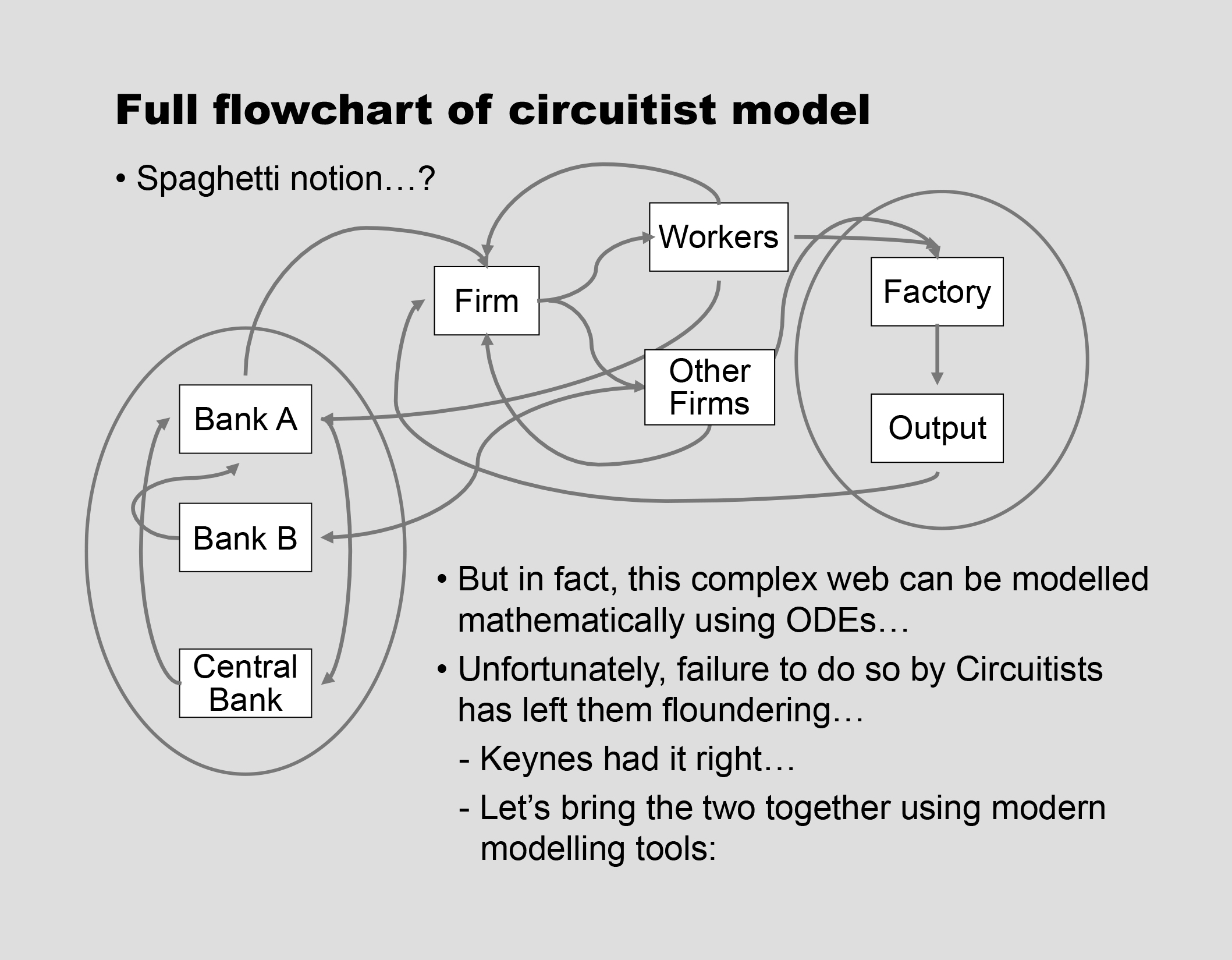

In between these two events, I “met” Graziani intellectually by happenstance. The Financial Economics lectures at my then University of Western Sydney were being given by a colourless Neoclassical whose lecturing style was so poor—he would literally stand in front of the class, and read verbatim from the textbook he had set for the course— that a student revolt was on the cards. I was asked to take over the course halfway through the semester to prevent the rebellion. I hastily reread many classics of Post-Keynesian literature, and I read Graziani’s “The Theory of the Monetary Circuit” for the first time. Though I still used a flowchart framework to present Graziani’s ideas—see Figure 2—the candle that would lead to Minsky had been lit.

Figure 2: My stylized flowchart outline of Graziani’s vision in 1998

I therefore arrived at Bergamo with a much greater appreciation of and respect for Graziani—regardless of my criticisms of the Neoclassical detritus in that paper—and took far more notice of him than I had in Paris. I found an elegant, erudite gentleman who stunned me with his capacity to speak in fully-formed, linguistically perfect paragraphs, in his second language of English. This inspired me all the more to do justice to his vision in my second language of mathematics. After a sabbatical at Bard College where I worked in Hyman Minsky’s old office, and interacted with Wynne Godley in the neighbouring office, the outlines of what would become Minsky were finalised.

Replacing the failed Neoclassical paradigm

There are many other critical insights from other acknowledged greats in Post-Keynesian economics that lead me to believe, as I argued in my most recent book (Keen 2021), that a full alternative paradigm to Neoclassical economics now exists. Most of these greats come from the Anglo-Saxon world—Keynes himself of course (Keynes 1937b), Minsky, Moore, Goodwin (Goodwin 1967), Godley (Godley 2004, 1999, 1996), Mosler (Mosler 2010). Graziani, along with Sraffa (Sraffa 1960, 1932, 1926, 1922), made a critical Italian contribution to this new paradigm. We will be forever in his debt.

Appendix

These are the equations generated by the model in Figure 1.

References

Andresen, Trond. 1998. ‘The macroeconomy as a network of money-flow transfer functions’, Modeling, identification and control, 19: 207-23.

Bellofiore, R., and Piero Ferri. 2001. The economic legacy of Hyman Minsky (Edward Elgar Publishers: Cheltenham, U.K. ; Northampton, Mass., USA).

Fontana, Giuseppe. 2004. ‘Rethinking Endogenous Money: a Constructive Interpretation of the Debate Between Horizontalists and Structuralists’, Metroeconomica, 55: 367-85.

Godley, Wynne. 1996. “Money, finance and national income determination: An integrated approach.” In. Levy Institute: The Levy Economics Institute of Bard College.

- 1999. ‘Money and Credit in a Keynesian Model of Income Determination’, Cambridge Journal of Economics, 23: 393-411.

- 2004. ‘Weaving Cloth from Graziani’s Thread: Endogenous Money in a Simple (but Complete) Keynesian Model.’ in Richard Arena and Neri Salvadori (eds.), Money, credit and the role of the state: Essays in honour of Augusto Graziani (Ashgate: Aldershot).

Goodwin, Richard M. 1967. ‘A growth cycle.’ in C. H. Feinstein (ed.), Socialism, Capitalism and Economic Growth (Cambridge University Press: Cambridge).

Graziani, Augusto. 1989. ‘The Theory of the Monetary Circuit’, Thames Papers in Political Economy, Spring: 1-26.

Keen, Steve. 1995. ‘Finance and Economic Breakdown: Modeling Minsky’s ‘Financial Instability Hypothesis.”, Journal of Post Keynesian Economics, 17: 607-35.

- 2001. ‘Minsky’s Thesis: Keynesian or Marxian?’ in Riccardo Bellofiore and Piero Ferri (eds.), The economic legacy of Hyman Minsky. Volume 1. Financial Keynesianism and market instability (Edward Elgar: Cheltenham, U.K.).

- 2021. The New Economics: A Manifesto (Polity Press: Cambridge, UK).

Keynes, J. M. 1936. The General Theory of Employment, Interest and Money ( Macmillan: London).

- 1937a. ‘Alternative theories of the rate of interest’, Economic Journal, 47: 241-52.

- 1937b. ‘The General Theory of Employment’, The Quarterly Journal of Economics, 51: 209-23.

Kuhn, Thomas. 1970. The Structure of Scientific Revolutions (University of Chicago Press: Chicago).

Minsky, Hyman P. 1977. ‘The Financial Instability Hypothesis: An Interpretation of Keynes and an Alternative to ‘Standard’ Theory’, Nebraska Journal of Economics and Business, 16: 5-16.

- 1982. Inflation, Recession and Economic Policy (Wheatsheaf: Sussex).

Moore, Basil J. 1979. ‘The Endogenous Money Supply’, Journal of Post Keynesian Economics, 2: 49-70.

Mosler, Warren. 2010. The 7 Deadly Innocent Frauds of Economic Policy.

Pratten, Stephen. 2023. ‘Veblen, Marshall and neoclassical economics’, Journal of Classical Sociology, 23: 63-88.

Samuelson, P. A. 1990. ‘Foreword.’ in Phillip Saunders and William B Walstad (eds.), The Principles of Economics Course: A Handbook for Instructors (McGraw-Hill: New York).

Sraffa, Piero. 1922. ‘The Bank Crisis in Italy’, The Economic Journal, 32: 178-97.

- 1926. ‘The Laws of Returns under Competitive Conditions’, The Economic Journal, 36: 535-50.

- 1932. ‘Dr. Hayek on Money and Capital’, The Economic Journal, 42: 42-53.

- 1960. Production of commodities by means of commodities: prelude to a critique of economic theory (Cambridge University Press: Cambridge).